Jersey's government has written to lenders asking them to agree to a set of terms to support homeowners amid mortgage increases.

It follows the Bank of England raising the base rate of interest to 5% last month - its highest level since 2008 - in a effort to curb inflation.

Assistant Chief Minister, Deputy Elaine Millar, who has political responsibility for Financial Services, is asking local banks to agree to the same terms of the UK's 'Mortgage Charter'.

The charter allows customers to move to interest-only payments or extend their mortgage term. It also bans repossessions within 12 months of the first missed payment.

The UK mortgage charter:

- Anyone worried about their mortgage repayments can call their lender for information and support, without any impact on their credit score and we would encourage you to contact your bank who are there to help

- Customers won’t be forced to have their homes repossessed within 12 months from their first missed payment

- Customers approaching the end of a fixed rate deal will be offered the chance to lock in a deal up to six months ahead. They will also be able to apply for a better deal right up until their new term starts, if one is available

- A new agreement between lenders, the FCA and the UK government permitting customers to switch to an interest-only mortgage for six months, or extend their mortgage term to reduce their monthly payments and switch back to their original term within the first six months, if they choose to. Both options can be taken without a new affordability check or affecting their credit score

- Support for customers who are up-to-date with payments to switch to a new mortgage deal at the end of their existing fixed rate deal without another affordability check

- Providing well-timed information to help customers plan ahead should their current rate be due to end

- Offer tailored support for anyone struggling and deploy highly trained staff to help customers. This could mean extending their term to reduce their payments, offering a switch to interest only payments, but also a range of other options like a temporary payment deferral or part interest-part repayment. The right option will depend on the customer’s circumstances.

85% of lenders there have signed the charter.

Deputy Millar says it's difficult to know if there will be similar co-operation.

"I know a lot of mortgages are done through our main banks, so I hope that would be the vast majority and most people with a mortgage through a bank will be treated sensibly.

We do have a significant amount of private lending in Jersey - with people going to independent lenders - and we do have less visibility over those."

Deputy Elaine Millar

Deputy Elaine Millar

She also says that the support should be there for as long as it will be needed.

"The letter was very open in terms of timescale. I think it's for as long as we have these pressures on islanders.

It may be that someone has been ok up until now and the recent rise in interest rates or higher inflation could have made it more difficult."

But Deputy Millar says that is not the reason for this move.

"We were considering writing when the proposition came in, so it was already identified as something the Council of Ministers wanted to do."

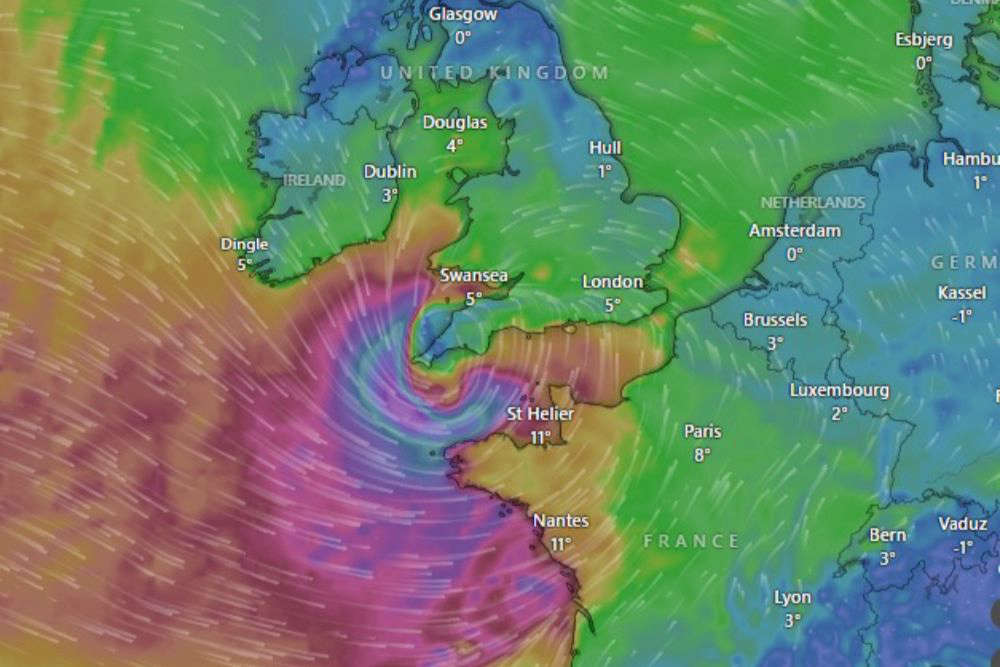

Storm Goretti prompts stay-at-home warning in the Channel Islands

Storm Goretti prompts stay-at-home warning in the Channel Islands

Islanders warned to stay inside during Storm Goretti

Islanders warned to stay inside during Storm Goretti

Little islanders now offered free chickenpox vaccine

Little islanders now offered free chickenpox vaccine

Islanders asked to help shape Jersey's online harms law

Islanders asked to help shape Jersey's online harms law

Children as young as 12 involved in joyriding in Jersey

Children as young as 12 involved in joyriding in Jersey

Assistant Health Minister seeks change to Assisted Dying Law

Assistant Health Minister seeks change to Assisted Dying Law

'Unfair' apprenticeship funding under review

'Unfair' apprenticeship funding under review

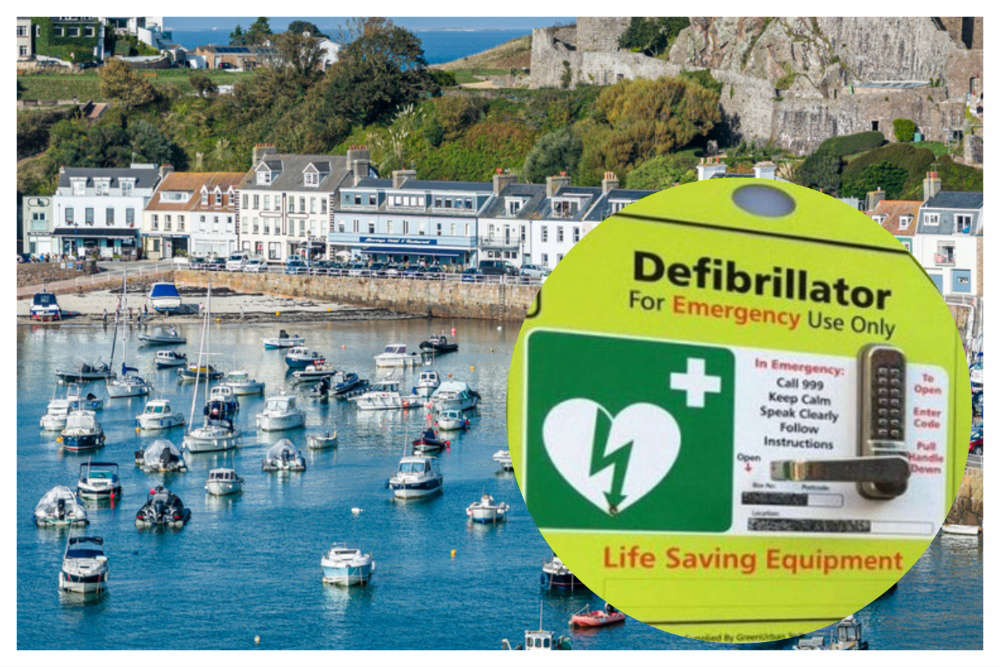

Hotel raises £3k for public defibrillator on Gorey Pier

Hotel raises £3k for public defibrillator on Gorey Pier